Having home mortgage protection is a condition of getting a home mortgage, consisting of self build home mortgages. It protects both you and also the lending institution throughout the mortgage term, by paying off the funding if you pass away. There is usually adaptability over the number of 'phase repayments' you can get, to best suit your develop. This is due to prices and durations typically being extended as well as some projects sadly not completing - making them a high risk to lenders. We can assist you obtain a mortgage for buying a piece of residential or commercial property and spending for the building and construction. Another wonderful advantage of self-build mortgages is that they can save you cash in the long run.

- The Old Water Tower is a crisply made Passivhaus new build situated in West Berkshire.

- Times Money Coach has joined Koodoo Mortgage to produce a mortgage contrast device.

- All self build home loan lending institutions, similar to traditional home mortgages, will certainly carry out a full price analysis prior to accepting proceed with any kind of application.

- Life insurance policy is a product designed to safeguard your loved ones' funds must you pass away throughout the term of the policy.

- We are an information only web site and purpose to provide the very best overviews and also pointers however can't ensure to be perfect, so do note you make use of the details at your own threat and also we can't approve liability if things go wrong.

Ulster gives you approximately 80% of the LTV of both residence and land incorporated. For help sourcing, the right self-build home mortgage service providers for your projectmake an enquirywith us and also we'll introduce you to the rightself-build mortgage broker. Many loan providers also call for evidence ofbuilding insuranceto get their loans. Nevertheless, some self construct home loan companies supply the cash at the start of each phase, so you can provide cash money in advance to purchase the materials and employ the needed workers in advance.

Do I Require To Pay Added Buy

Debtors can pick the accelerator or the defaults choice, or a mix of both.Make an enquiryfor much more info. Only candidates in particular areas can request the company's self build financings. Make allowances for added prices turning up in your task to make sure that you have an extra conventional price quote in your strategies. In this way, if mistakes do happen and additional prices do arise, after that with any luck you will certainly still have the ability to manage it and also https://eduardosvpm.bloggersdelight.dk/2022/09/02/a-greater-home-mortgage-rate-can-in-fact-save-you-cash-with-this-underrated-home-loan/ follow through with constructing your desire house. A construct guarantee is not a Hop over to this website required financing demand of our home mortgage and also we are happy with a Building Guideline Completion Certificate.

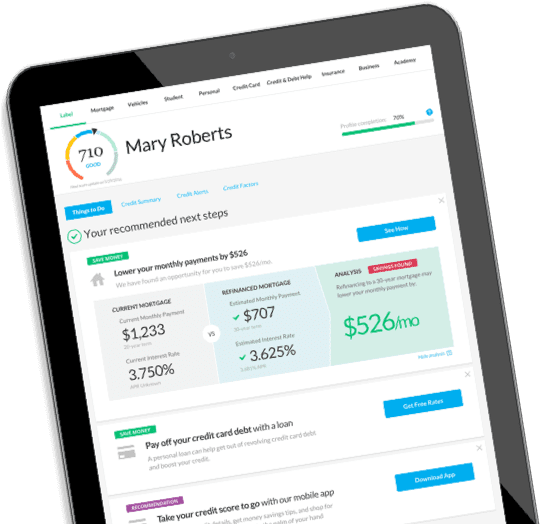

Home Loans Contrast

Building your own house can potentially save you thousands, specifically if you currently own land and also have intending authorization. Building work is exempt from stamp responsibility, as is the value of the finished home. That indicates you will only have to pay duty on the value of the land itself if it goes beyond ₤ 125,000, which is likely to be much lower than the value of the finished residential or commercial property.

Can I Get A Self Build Mortgage To Build A Log Cabin?

This suggests numerous self construct property owners avoid paying stamp obligation, which can save them thousands of extra pounds. The products and work might seem pricey to begin with, however numerous self construct home owners tend to discover that their building's worth upon conclusion becomes a lot higher than it cost to construct in the starting point. With a common home mortgage you could put down a down payment of around 10% to 20%, however with a Click here! self build home mortgage, you require to install even more of the cash money in advance. Lenders will commonly beware when it comes to a self construct project, so it is essential to be as prepared economically as possible. The last couple of payments been available in when the roofing has been constructed as well as secured, when the interior walls have actually been plastered, as well as ultimately when the entire home has actually been totally developed. Self develop mortgages, as the name recommends, are home loans that fund your project to construct your own house.

The main distinction is that a self-build home loan releases money in stages instead of giving you one large round figure. It lowers the risk for the lending institution and also indicates they can examine you're utilizing the money as planned. It likewise aids guarantee that you do not lack funds mid-way via the project. Via Aid to Develop, you can apply for an equity funding from the government of in between 5% and also 20% of the approximated build expense (up to 40% in London).

We call our discounts 'C-Change discounts' just because we're intending to make a 'sea-change' of distinction to our environment with each residential property or task we fund. As a building culture with an one-of-a-kind objective to construct a greener society, we offer on projects as well as residential or commercial properties that support our objectives through their minimized impact on our atmosphere. Making your residence power effective is a significant way you can support tackling environment modification-- while reducing your energy bills.